- Our Inspired Quotes Click Here

- 08 8311 5155

- 0480 145 815

- admin@nrmjohnson.com.au

- Filter by

- Categories

- Tags

- Authors

- Show all

10 October 2022

Published by NRM Johnson on 10 October 2022

Categories

Uncategorised

Superannuation may not be the first thing that springs to mind as a self-employed individual, but just like how looking after your tax and business expenses […]

6 October 2022

Published by NRM Johnson on 6 October 2022

Categories

Uncategorised

Superannuation is an attractive target for scammers as a significant volume of funds are placed into super funds by Australians. You can take some straightforward steps […]

19 September 2022

Published by NRM Johnson on 19 September 2022

Categories

Uncategorised

Superannuation payments need to be made to your employees, otherwise, stringent penalties can be implemented that could be financially more devastating to your business than simply […]

14 September 2022

Published by NRM Johnson on 14 September 2022

Categories

Uncategorised

Have you had a superannuation account opened on your behalf by an employer before November 2021, in which employer contributions were made, that is not your […]

29 August 2022

Published by NRM Johnson on 29 August 2022

Categories

Uncategorised

Individuals may be looking to opt for an SMSF because these provide entire control over where the money is invested. While this may have traditionally been […]

24 August 2022

Published by NRM Johnson on 24 August 2022

Categories

Uncategorised

During the onset of the pandemic in 2020, many Australians took advantage of the early access to their super that was a part of the financial […]

8 August 2022

Published by NRM Johnson on 8 August 2022

Categories

Uncategorised

If you have a Self Managed Superannuation Fund (SMSF), the Fund is considered to be a trust and must have a trustee. There are two options […]

3 August 2022

Published by NRM Johnson on 3 August 2022

Categories

Uncategorised

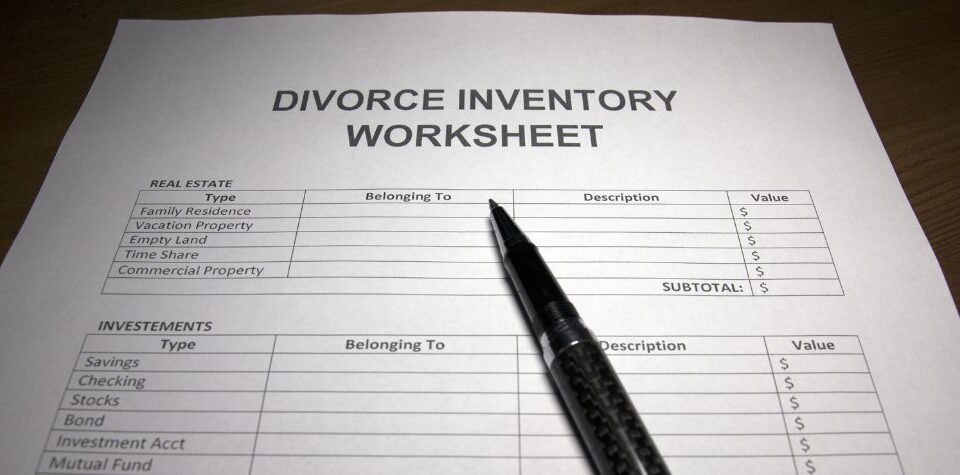

Were you aware that if you were to split up with your current partner, you may be able to file a legal claim for up to […]

18 July 2022

Published by NRM Johnson on 18 July 2022

Categories

Uncategorised

It is your responsibility as an employer to set up your business to pay super into your eligible employees’ chosen super funds or their stapled super […]